The 2026 electronic invoicing reform marks a major shift for French companies. After several years of announcements, postponements, and technical clarifications, the timeline is now clear: all companies must be able to receive electronic invoices starting September 1, 2026. The good news is that Odoo is already ready. Even better, Dynapps France supports French SMEs and mid-sized companies through every step of this transition, with proven field experience and more than 600 Odoo projects deployed.

Electronic invoicing 2026: what the updated timeline requires

Receiving electronic invoices: mandatory for all companies starting September 1, 2026. Issuing electronic invoices:

- September 1, 2026 for large companies and mid-sized businesses

- September 1, 2027 for SMEs and micro-enterprises

In other words, even the smallest businesses must start anticipating their compliance and adapting their systems now.

Why is electronic invoicing becoming mandatory?

The rollout of electronic invoicing aims to achieve several goals:

- Reducing VAT fraud

- Improving the reliability of exchanges between businesses

- Automating accounting processes

- Simplifying tax audits

- Reducing administrative costs

- Saving time thanks to pre-filled invoices

This reform follows the already existing requirement to use Chorus Pro for invoices sent to the public sector.

What electronic invoicing covers

Electronic invoicing applies to all B2B invoices subject to VAT and issued in France. This means that each invoice issued or received must be digital and transmitted using a format that complies with regulations. Additionally, certain information must be transmitted for other types of transactions as part of e-reporting.

Concrete examples of electronic invoicing application

B2C sales: when your company sells to individuals, certain transaction data must be transmitted to the tax authorities to ensure traceability and compliance.

Clients not subject to VAT: if you invoice an association, a micro-enterprise, or any entity not subject to VAT, relevant invoice data must also be reported through e-reporting.

Transactions with foreign companies: when you provide products or services to a business located outside France, the electronic invoice must be issued and specific information transmitted to French tax authorities to ensure regulatory compliance.

Regulatory framework for 2026 electronic invoicing

The implementation of electronic invoicing relies on a well-defined legal framework:

- Decree no. 2022-1299, which sets the obligations for issuing, transmitting, and receiving electronic invoices.

- The order dated October 7, 2022, which details the required formats and technical procedures for compliance.

Odoo is ready for 2026 electronic invoicing

Odoo is now a certified Peppol access point, the secure European network for exchanging electronic invoices.

This means your ERP can send and receive electronic invoices via Peppol and transmit them to Chorus Pro in full compliance.

A native, simple and free integration

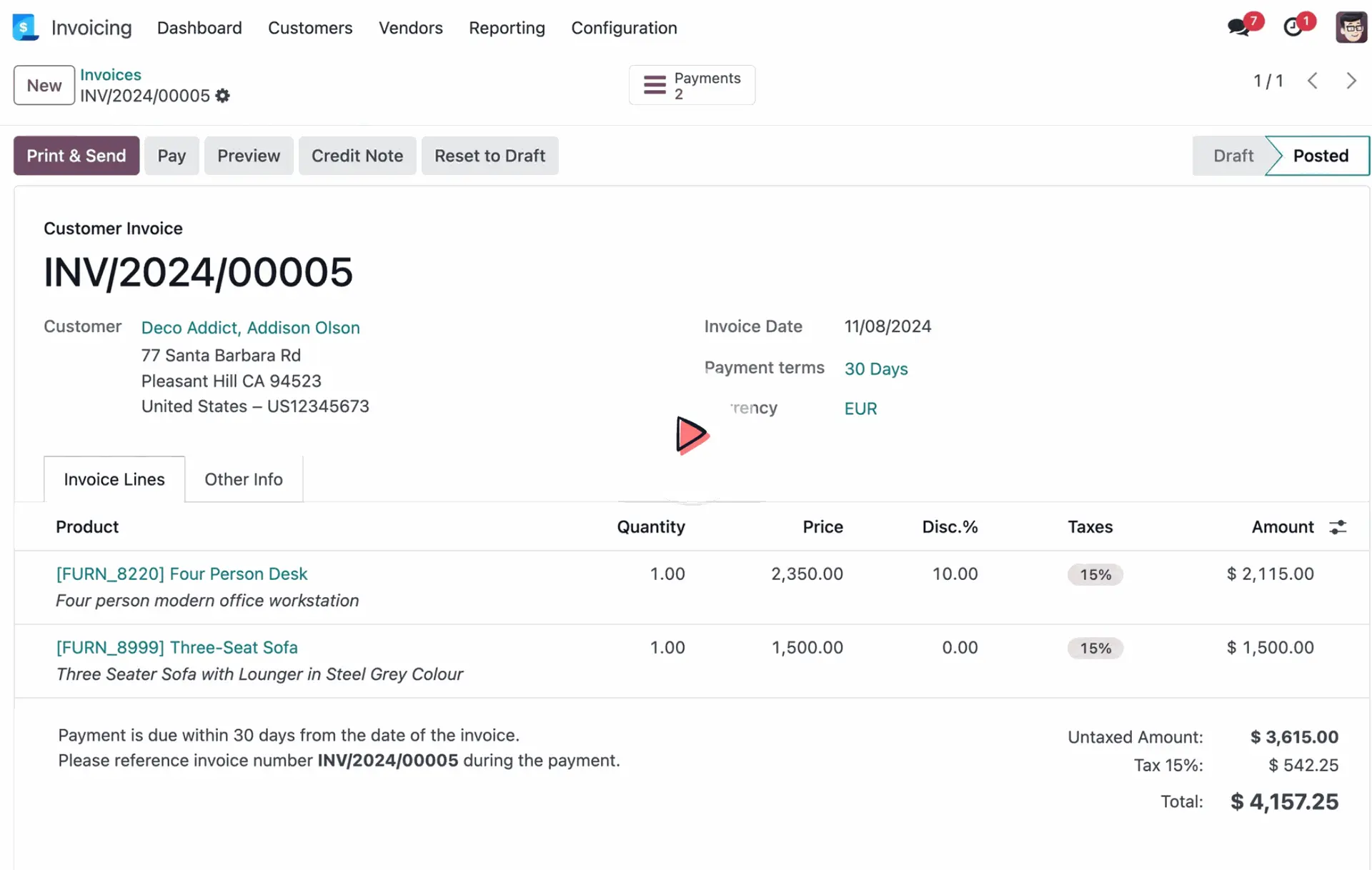

Odoo provides the Peppol connector free of charge, integrated directly into its accounting system.

- The tool is unlimited for users, with no additional cost.

- All required formats are supported: UBL, CII, Factur-X.

- Management of regulatory statuses: issued, submitted, rejected.

- Secure exchanges and automatic data standardization.

Make everyday invoicing easier with Odoo

With Odoo Invoicing:

Your invoice in one click: client details, products, prices, and taxes are already prepared.

All your invoices in one place: mobile app to issue, track, and create batch payments anywhere.

Get paid faster: customer portal with online payment using your client’s preferred method.

Bank automation and tracking: connect your bank, monitor pending payments, and set automatic reminders.

Advanced features for complete management

- Electronic invoicing in 160 countries

- Recurring invoices management for subscriptions and automated services

- Multi-currency support with automatic conversion

- Automated postal mail: sending and tracking invoices

- Refunds and credit notes with simplified handling

- Dynamic reports and dashboards with real-time visibility

- Customization to match your brand identity

Why choose Dynapps for your electronic invoicing project?

Technology alone is not enough.

To succeed in the 2026 transition, companies need a partner who understands their operational reality.

This is precisely where Dynapps France brings significant added value.

Local support, close to french businesses

Our consultants, developers, and project managers operate across the country, working directly alongside SMEs and mid-sized companies.

We take the time to:

- analyze your processes

- understand your constraints

- model your accounting workflows in Odoo

- secure your compliance

A recognized Odoo expertise

Dynapps represents:

- More than 600 successful implementations

- 12,500 active users

- A proven methodology

- Full mastery of accounting modules and Peppol EDI

A complete and controlled implementation

We support you with:

- Deploying the Peppol module in Odoo

- Mapping your invoicing flows

- Ensuring the compliance of your data

- Preparing your teams

- Change management

- Post-migration support

Prepare for 2026 electronic invoicing now

As the deadline approaches, more companies are upgrading their systems. Planning ahead means avoiding last-minute stress and unpleasant surprises.

Let's Connect

Do you want to check whether your Odoo setup is ready for 2026?

Do you need help implementing Peppol?

Are you starting an ERP project and want a compliant system from day one?

Let’s talk. Dynapps France is here to guide you every step of the way.

SEO FAQ – Electronic Invoicing 2026

In this section, you can address common questions efficiently.

What is Electronic Invoicing 2026?

It is the obligation for all VAT-registered companies to receive and, depending on their size, to issue electronic invoices through a secure, standardized network (Peppol in France).

Who is affected by Electronic Invoicing 2026?-

All French companies registered for VAT. Issuing becomes mandatory in 2026 for large companies and mid-sized businesses, and in 2027 for SMEs and micro-enterprises.

Why use Odoo for electronic invoicing?

With integrated Peppol, Odoo enables automatic sending and receiving of electronic invoices, and centralizes accounting, CRM, and sales in a single tool.

How does Dynapps France support businesses?

We analyze your processes, configure Odoo according to your needs, train your teams, and provide post-migration support for a smooth transition.

What are the benefits of electronic invoicing for businesses?

Workflow automation, cost reduction, full traceability, regulatory compliance, and time savings in accounting management.